Augila Tax Consultancy

TDS Return Filing

Preparation and filing of all TDS returns (Form 24Q, 26Q, 27Q), reconciliation with challans, automated due-date tracking, and timely submission to avoid penalties.

TDS Services to the buyer of the property from NRI or Foreign National.

TDS Services to the buyer of the property

Preparation of TDS Summary & Reports

Monthly and quarterly TDS summaries, deduction statements, mismatch reports, and year-end Form 16/16A generation—ensuring full visibility and compliance readiness

TDS Return Forms

Quarterly TDS Return Filing (24Q, 26Q, 27Q, 27EQ)

Revised TDS Returns

Once the TDS returns are submitted and errors are detected like incorrect challan details or the PAN is not provided or incorrect PAN is provided then the tax amount credit with the government will not be reflected in the Form 16A / Form 26AS. To make sure that the amount is properly credit and reflected in Form 16/ Form 16A / Form 26 AS a revised TDS return has to be filed.

What is TCS?

Tax Collected at Source (TCS) is a provision under the Indian Income Tax Act, 1961 (mainly Section 206C) that requires certain sellers (collectors) to collect tax from the buyer at the time of sale of specified goods/services or receipt of certain amounts. The seller then deposits this tax with the Government of India. Income Tax India+1

It is essentially a mechanism for advance collection of income tax. Income Tax India

The tax is collected by the seller/collector and paid to the government.

How TCS Works?

When specified goods or services are sold, the seller charges a certain percentage extra on top of the sale price as TCS and collects it from the buyer at the time of sale/payment. That amount is then deposited with the Income Tax Department.

Basic Legal Basis

Section: 206C of the Income Tax Act, 1961

Applicable to: Sale of specific goods, foreign remittances, sale of motor vehicles above certain value and other notified transactions.

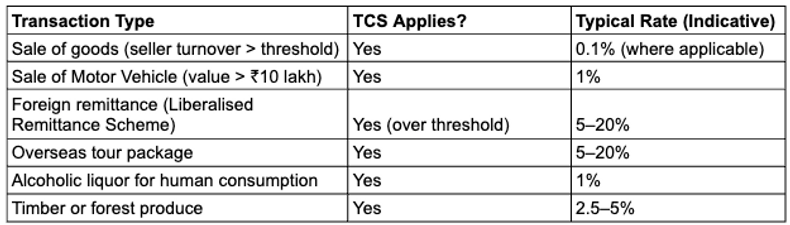

Examples of Transactions Where TCS Applies ???

Due Dates & Compliance :-

TCS must be deposited periodically (monthly/quarterly) with the Government. Quarterly returns are filed in Form 27EQ. Certificates are issued to buyers in Form 27D, which buyers can use to claim credits